Financial Results Highlights

(Fiscal 2023)

Performance

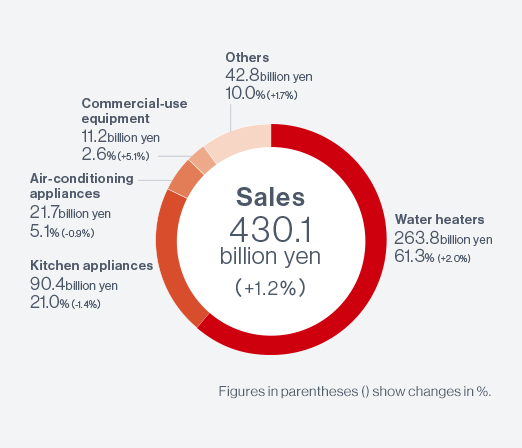

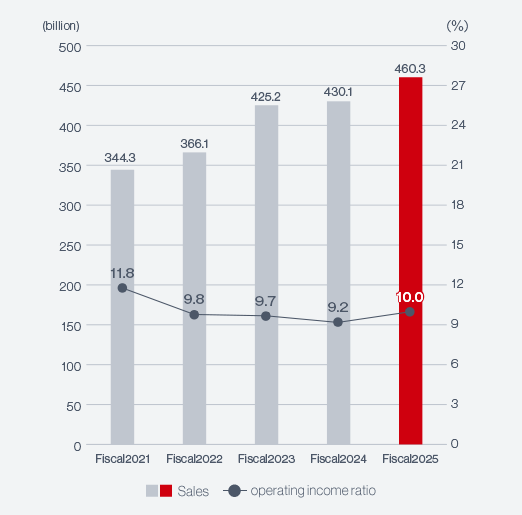

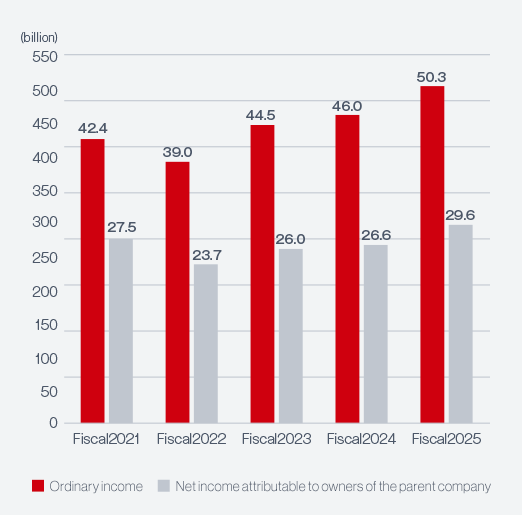

Consolidated net sales for the year amounted to ¥425,229 million, up 16.1% from the previous year. Operating income rose 15.5%, to ¥ 41,418 million, and ordinary income climbed 14.1%, to ¥44,565 million. Net income attributable to owners of the parent company grew 9.9%, to ¥26,096 million.

Results by Geographical Segment

-

Japan

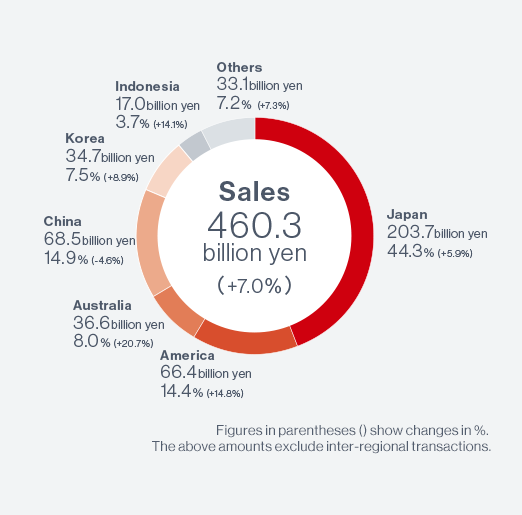

In Japan, we posted a substantial increase in sales of mainstay water heaters, centered on hybrid and other models with heating systems, as we worked to strengthen our production system to eliminate supply delays. Despite continued high costs of procuring raw materials and parts, as well as distribution and energy costs, we reported higher sales of mainstay products and benefited from the weaker yen and cost reduction efforts. As a result, sales in Japan rose 14.8%, to ¥196,838 million, and operating income jumped 35.3%, to ¥23,597 million.

-

United States

Despite temporary delays in the supply of tankless water heaters from Japan due to tight parts procurement and disruptions in international logistics, local sales of water heaters increased thanks to the commissioning of a new plant in April 2022 and increased supply from Japan. Although worsening housing market conditions led to stagnation in demand in the second half of the year, total U.S. sales increased 24.6%, to ¥55,750 million. However, these factors did not fully compensate for higher expenses and logistics costs associated with the new plant. Consequently, operating income fell 85.1%, to ¥313 million.

-

Australia

Sales in Australia increased 7.3%, to ¥27,655 million, due to growth in sales of commercial air conditioners and tank-based water heaters, as well as foreign exchange factors. This was despite lower sales of mainstay products due to delays in the supply of tankless water heaters and room heaters from Japan amid inflation and weak housing market conditions. However, the decline in sales (in local-currency terms) and soaring raw material prices and logistics costs led to a 27.2% fall in operating income, to ¥1,180 million.

-

China

In China, our business was affected by temporary restrictions on production and sales activities due to the stagnant housing market caused by stricter policies for developers and lockdowns in Shanghai related to COVID-19. After the lockdowns were lifted, however, we benefited from a rebound in production and sales activities, as well as growth in sales of high-value-added products, such as gas water heaters with built-in quick-heating units. Accordingly, sales in China, increased 25.3% to ¥66,150 million, and operating income jumped 56.5% to ¥10,569 million.

-

South Korea

In South Korea, weakening market sentiment due to rising prices and interest rates, as well as a decrease in housing sales and a reduction in government subsidies for eco-friendly products, caused the market to contract and led to a decline in sales of mainstay boilers. Consequently, sales in South Korea edged down 0.1%, to ¥32,094 million. Operating income fell 32.3%, to ¥705 million, due to lower sales of mainstay products and repair and inspection expenses for commercial fryers.

-

Indonesia

Despite weak sales of mainstay tabletop stoves, sales of built-in hobs (stovetops) and range hoods increased on the back of strong demand thanks to sales promotion activities and an expanded product lineup. As a result, sales in Indonesia increased 19.3% to ¥16,203 million. However, operating income declined 15.1%, to ¥ 2,400 million, due to continued high raw material prices, especially for steel.

-

-

-

-