Corporate Governance

Basic Principles

- Rinnai views reinforcement and enhancement of corporate governance as important management priorities from the perspectives of strengthening competitiveness and continually improving corporate value of the Group.

- Rinnai takes care to preserve equality of shareholders by ensuring that their rights are essentially protected and that those rights can be exercised smoothly.

- Rinnai views appropriate cooperation with all stakeholders as essential to improving corporate value and, through its business activities, strives for its own growth together with social and economic prosperity.

- Rinnai emphasizes highly transparent management through the swift and appropriate disclosure of wide-ranging information while stepping up efforts to ensure that disclosure of company information is based on legal regulations.

- Rinnai's Board of Directors recognizes its fiduciary responsibilities to shareholders and strives to continually improve corporate value though transparent, fair, swift, and resolute decision-making.

- Rinnai encourages mutual communication through dialog with shareholders and other stakeholders in order to build relationships of trust with those stakeholders.

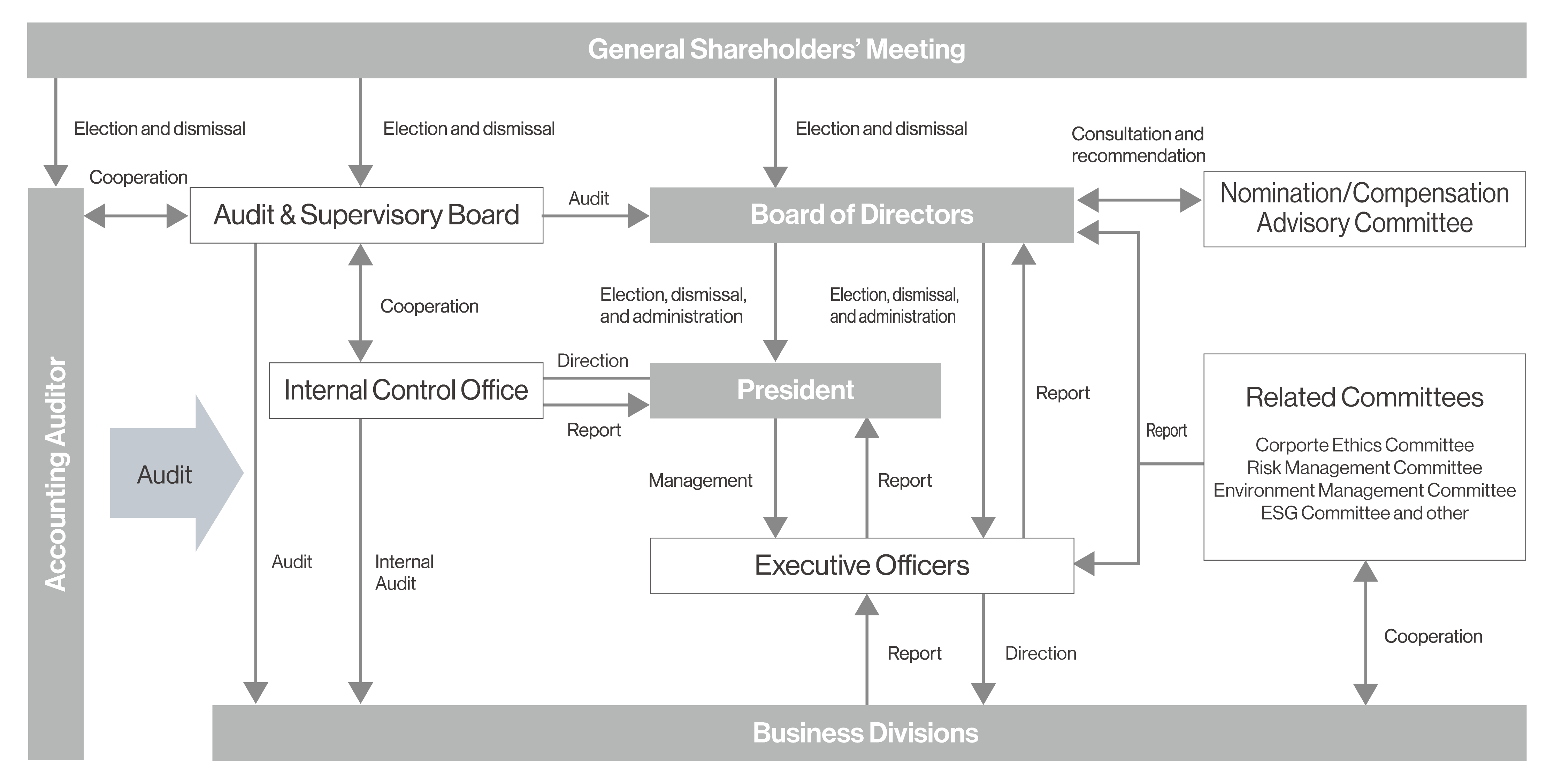

Corporate Governance Structure

Audit & Supervisory System

There are four Audit & Supervisory Board Member, two of whom are outside Audit & Supervisory Board Member. Audit & Supervisory Board Member attend Board of Directors meetings and other important meetings, where they monitor directors' execution of their duties, the development of the internal control system, and the overall performance of duties. In addition, an external account auditor audits the Company's accounts and verifies from a third-party perspective the legality of the internal control system as it relates to financial accounts.

Board of Directors

The Board of Directors consists of nine members, among whom four outside directors included and meet once a month in principle. The Board makes decisions on major management issues and also oversees business execution by Board members. Some of directors, from the Chairman down, serve concurrently as executive officers, whose role is to convey on the decisions of the Board to the head executives of the relevant divisions. The board checks on business operations and discuss issued at general business meetings and at other business meetings held on a quarterly basis. Moreover, the term of Directors should be fixed as one year in order to clarify their management responsibilities and to increase the opportunity of shareholders' confidence to them.

Skills Matrix of Directors (Areas particularly expected of the relevant directors)

*The following table does not represent all of the candidates' knowledge and experience.

| Expertise and Experience | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate management | Global management | Technology (Development / Production / Environment) |

Business Plans / Marketing | Finance / Accounting / Capital Policy | Human Resources Strategy | Governance / Legal Matters / Risk Management | Sustainability | IT / DX | |

| Kenji Hayashi | ✓ | ✓ | - | - | ✓ | ✓ | ✓ | - | - |

| Hiroyasu Naito | ✓ | ✓ | ✓ | - | ✓ | - | - | ✓ | - |

| Tsunenori Narita | ✓ | - | ✓ | ✓ | - | ✓ | - | - | - |

| Hideyuki Shiraki | - | - | - | ✓ | - | ✓ | - | - | ✓ |

| Kazuto Inoue | - | ✓ | ✓ | - | - | - | - | - | ✓ |

| Takashi Kamio | ✓ | ✓ | - | ✓ | - | - | ✓ | - | - |

| Tadashi Ogura | ✓ | - | ✓ | - | - | ✓ | ✓ | - | - |

| Yoko Dochi | - | ✓ | - | - | ✓ | - | ✓ | ✓ | - |

| Kumi Sato | - | ✓ | - | - | - | ✓ | - | ✓ | ✓ |

Reasons for Matrix Selection

| Skills | Reasons for Matrix Selection (Requirements underpinning achievement of Medium-Term Management Plan "New ERA 2025") |

|---|---|

| Corporate management | It is vital for Rinnai, which seeks to address global social challenges through core technologies under the business themes of "heat and lifestyles" and "health and lifestyles," to have directors who possess a wealth of knowledge in consumer services as well as management experience at manufacturing companies, research facilities and other organizations. |

| Global management | Rinnai must have directors who possess overseas business management experience and a deep understanding of and involvement at the local level, that is, the local lifestyle and culture and the environment, to support business expansion in global markets, particularly Japan, the United States and China, and to support sustainable growth. |

| Technology (Development / Production / Environment) |

Basic research into the use of all sorts of energy sources and component development as well as measures to maintain a highly reliable production system are essential to an expanded lineup of products that contribute to "heat and lifestyles" and "health and lifestyles," and Rinnai must therefore have directors with demonstrated knowledge and experience in development, production and the environment. |

| Business Plans / Marketing | Rinnai must have directors with demonstrated knowledge and experience in business planning and marketing to gather information on the real needs of consumers and develop product planning and sales planning matched to these needs, and to reinforce business activities related to direct sales. |

| Finance / Accounting / Capital Policy | Rinnai must have directors with demonstrated knowledge and experience in financial, accounting and capital policy disciplines for optimum allocation to strategic investments, return to shareholders and risk-responsive capital from the current added-value and profit-emphasis management perspective as well as a medium-term perspective. |

| Human Resources Strategy | Rinnai must have directors with solid knowledge and experience in the field of talent strategy and development in order to achieve sustainable growth by implementing personnel system reforms that support employees' challenges and self-realization, proposing new ways of working, and enhancing brand power. |

| Governance / Legal Matters / Risk Management | To maintain an appropriate global governance structure and ensure the continuity of business in an environment free from misconduct, it is necessary to have directors with solid knowledge and experience in the fields of corporate governance, legal affairs, and risk management. |

| Sustainability | To achieve a sustainable society, it is necessary to address social issues and incorporate them into business activities by considering them as revenue opportunities. This requires directors with solid knowledge and experience in the field of sustainability. |

| IT / DX | Rinnai must have directors with demonstrated knowledge and experience in IT and DX, not only to promote digital transformation throughout the Corporation but also to establish an information infrastructure to thwart cyberattacks and to utilize leading-edge information technologies. |

Nomination/Compensation Advisory Committees

To enhance the objectivity and transparency of decisions pertaining to nomination of and compensation for senior management and directors, Rinnai established the Nomination Advisory Committee and the Compensation Advisory Committee, with the majority of members being independent outside directors, to act in an advisory capacity to the Board of Directors. Director, Audit and Supervisory Board member and executive officer nominations and director and executive officer compensation are discussed by the respective advisory committee, with a final decision made by the Board of Directors.

Remuneration for Directors and Audit & Supervisory Board Members (Fiscal 2024, ended March 31, 2023)

| Total Remuneration (Millions of yen) |

Total Remuneration by Item (Millions of yen) |

Recipients (persons) |

|||

|---|---|---|---|---|---|

| Basic component | Annual bonus | Restricted stock | |||

| Directors (including outside directors) |

350 (27) |

261 (27) |

72 (-) |

16 (-) |

9 (4) |

| Audit & Supervisory Board members (including outside members) |

45 (13) |

45 (13) |

- (-) |

- (-) |

5 (2) |

| Total (including outside members) |

396 (41) |

307 (41) |

72 (-) |

16 (-) |

14 (6) |

Director Compensation System (Fiscal 2024)

A summary of the Corporation's policies on determining compensation for individual directors is given below.

- 1Basic principles on determining compensation for directors

-

I. Promoting solid corporate value creation over the medium to long term - The level and composition of compensation are set so that directors will be strongly motivated to realize increased corporate value and attain goals through the concerted efforts of the entire Corporation.

- Directors will be motivated to routinely attain performance targets every fiscal year and create corporate value over the medium to long term by exercising appropriate quantitative evaluation on the basis of financial performance indicators and assessment of medium-to-long-term efforts on compensation.

- Steady improvement of corporate value is sought through directors holding the Corporation's shares for the medium to long term, thus having common interests with shareholders.

II. Securing objectivity and transparency to underline our accountability to a broad range of stakeholders, including shareholders - Policies on determining compensation are deliberated by the Compensation Advisory Committee, mainly composed of outside directors, and then ratified by the Board of Directors based on the Committee's recommendations.

- The level and composition ratio of compensation are continuously validated by an objective comparison with those of comparable companies.

- 2Structure of compensation

-

Compensation for directors consists of a basic component (fixed compensation) and a performance-linked component in a ratio of approximately 70:30 for the purpose of providing a sound motivation for increased corporate value and target achievement. Performance-linked compensation consists of an annual bonus, designed to promote steady attainment of performance targets every fiscal year, and a restricted stock compensation, designed to seek steady improvement of corporate value through sharing interests with shareholders by holding the Corporation's shares for the medium to long term.

Compensation for outside directors is limited to a basic component (fixed compensation) only, in order to promote proper conduct of their duties to supervise and give advice to management from a position independent of executive management.The composition of compensation and summary of each component are as follows:

Composition of compensation

- 70%

- 20%

- 10%

- Basic component

- Annual bonus

- Restricted stock

Summary of each component

Type of compensation Summary Basic compensation Cash compensation paid monthly in a fixed amount based on position and duties Annual bonus Cash compensation designed to promote steady attainment of performance targets every fiscal year and corporate value creation

over the medium to long term Consisting of a corporate performance-linked component(80%) and an individual performance-evaluation component(20%)

- The corporate performance-linked component will range from 0% to 150% of the standard amount, depending on the degree of attainment of targeted consolidated operating income and nonconsolidated operating income, which are key performance indicators of the Corporation

- The individual performance component will range from 0% to 150% of the standard amount, depending on major indicators of each director's area of responsibility and an evaluation of efforts towards medium-to long-term growth and ESG, etc.

- Determined amounts will be paid as a lump-sum cash payment after the end of each fiscal year

Restricted stock Stock-based compensation designed to contribute to steady improvement of corporate value through shared interests with shareholders by holding the Corporation's shares for the medium to long term

- In principle, a certain number of shares with transfer restrictions are issued each fiscal year in accordance with the director’s position and responsibilities, and the restrictions on transfer are lifted when the director retires.

- Corporate value enhancement levels are evaluated using total shareholder return and other indicators. After deliberation by the Compensation Advisory Committee, the number of shares to be delivered may be added within the maximum remuneration amount and the maximum number of shares decided by the Ordinary General Shareholders’ Meeting.

If any individual director holds a number of shares exceeding a specified number over the medium to long term, the restricted stock may be included in an annual bonus and the director will receive only an annual bonus as a performance-linked compensation incentive. Directors eligible to receive restricted stocks are identified at a meeting of the Compensation Advisory Committee, and then ratified by the Board of Directors.

- 3Level of compensation

- The level of compensation for directors (excluding outside directors) is set so that directors are strongly motivated to realize increased corporate value and attain goals through the concerted efforts of the entire Corporation. It is determined on the basis of position and duties and by using objective data on executive compensation gathered through a survey conducted by an outside expert agency (Willis Towers Watson's Executive Compensation Data) and using those of selected comparable companies as a benchmark.

- 4Process of determining compensation

-

Policies on determining compensation for directors are deliberated objectively at a meeting of the Compensation Advisory Committee, composed of a majority outside directors, and ratified by resolution of the Board of Directors based on the Committee's recommendations. The amount of each director's compensation, including an assessment of an individual performance-evaluation component, is determined by deliberation of the Compensation Advisory Committee to which the Board of Directors has resolved to delegate authority, ensuring more objectivity and transparency in the process of determining compensation.

Deliberations of the Compensation Advisory Committee are conducted from an objective viewpoint and by referring to expertise about compensation systems. Accordingly, information is obtained from an outside expert agency (Willis Towers Watson in fiscal 2024) when necessary.

The following are the members of the Compensation Advisory Committee who deliberated policies for the 74th fiscal year and their activities during the fiscal year.Members

- Nobuyuki Matsui, Outside Director (Chairman of the Committee)

- Takashi Kamio, Outside Director

- Tadashi Ogura, Outside Director

- Hiroyasu Naito, President and Representative Director

Activities

- May 23, 2023: Decision of annual bonus for the 73rd fiscal year, and deliberation on compensation policies for the 74th fiscal year

- June 29, 2023: Deliberation on selection of Compensation Advisory Committee Chairman and individual amounts of compensation for officers (directors) for the 74th fiscal year

Director Compensation System (Fiscal 2025)

At a meeting of the Board of Directors held on April 25, 2024, the Corporation resolved to revise its policy for determining details of compensation for directors in the 75th fiscal year. The revised policy for determining compensation is summarized as below.

- 1Basic principles on determining compensation for directors

-

I. Promoting solid corporate value creation over the medium to long term - The level and composition of compensation are set so that directors will be strongly motivated to realize increased corporate value and attain goals through the concerted efforts of the entire Corporation.

- Directors will be motivated to routinely attain performance targets every fiscal year and create corporate value over the medium to long term by exercising appropriate quantitative evaluation on the basis of financial performance indicators and assessment of medium- to- long-term efforts on compensation.

- Steady improvement of corporate value is sought through directors holding the Corporation’s shares for the medium to long term, thus having common interests with shareholders.

II. Securing objectivity and transparency to underline our accountability to a broad range of stakeholders, including shareholders - Policies on determining compensation are deliberated by the Compensation Advisory Committee, mainly composed of outside directors, and then ratified by the Board of Directors based on the Committee's recommendations.

- The level and composition ratio of compensation are continuously validated by an objective comparison with those of comparable companies.

- 2Structure of compensation

-

Compensation for directors consists of a basic component (fixed compensation) and a performance-linked component in a ratio of approximately 60:40 for the purpose of providing a sound motivation for increased corporate value and target achievement.

Performance-linked compensation consists of an annual bonus, designed to promote steady attainment of performance targets every fiscal year, and a restricted stock compensation, designed to seek steady improvement of corporate value through sharing interests with shareholders by holding the Corporation’s shares for the medium to long term. Compensation for outside directors is limited to a basic component (fixed compensation) only, in order to promote proper conduct of their duties to supervise and give advice to management from a position independent of executive management.The composition of compensation and summary of each component are as follows:

Composition of compensation

- About60%

- About20%

- About20%

- Basic component

- Annual bonus

- Restricted stock

Summary of each component

Type of compensation Summary Basic compensation Cash compensation paid monthly in a fixed amount based on position and duties Annual bonus Cash compensation designed to promote steady attainment of performance targets every fiscal year and corporate value creation

over the medium to long term Consisting of a financial evaluation portion (80%) and a nonfinancial evaluation portion (20%)

- The financial evaluation portion varies between 0 and 200% of the standard amount, depending on the degree to which key performance indicators (consolidated operating income and ROE) have been achieved.

- The non-financial evaluation portion varies between 0 and 200% of the standard amount, depending on the degree of improvement in employee engagement and qualitative evaluations of medium- to long-term initiatives based on each director's area of responsibility.

- Determined amounts will be paid as a lump-sum cash payment after the end of each fiscal year

Restricted stock Stock-based compensation designed to contribute to steady improvement of corporate value through shared interests with shareholders by holding the Corporation’s shares for the medium to long term

- In principle, a certain number of shares with transfer restrictions are issued each fiscal year in accordance with the director’s position and responsibilities, and the restrictions on transfer are lifted when the director retires.

- Corporate value enhancement levels are evaluated using total shareholder return and other indicators. After deliberation by the Compensation Advisory Committee, the number of shares to be delivered may be added within the maximum remuneration amount and the maximum number of shares decided by the Ordinary General Shareholders’ Meeting.

If any individual director holds a number of shares exceeding a specified number over the medium to long term, the director may not be eligible to receive the restricted stock and receive only an annual bonus as a performance-linked compensation incentive given the purposes of performance-linked compensation and effectiveness as incentive. Directors eligible to receive restricted stocks are identified at a meeting of the Compensation Advisory Committee, and then ratified by the Board of Directors.

- 3Level of compensation

- The level of compensation for directors (excluding outside directors) is set so that directors are strongly motivated to realize increased corporate value and attain goals through the concerted efforts of the entire Corporation. It is determined on the basis of position and duties and by using objective data on executive compensation gathered through a survey conducted by an outside expert agency (Willis Towers Watson’s Executive Compensation Data) and using those of selected comparable companies as a benchmark.

- 4Stock ownership guidelines

-

Effective the 75th fiscal year (ending March 31, 2025), the Corporation will establish the following guidelines for the number of shares of its stock to be held by directors during their terms of office, with the aim of steadily increasing corporate value and further promoting common interests between directors and shareholders.

- President and representative directors: Shares equivalent to 1.5 times the amount of base compensation by the end of three years after assuming office

- Other directors (excluding outside directors): Shares equivalent to one time the amount of base compensation by the end of three years after assuming office

- 5Malus Clawback Clause

-

In the event of significant corrections to the financial statements used as the basis for calculating annual bonuses, or the recipient has committed a serious violation of laws or internal regulations, we have introduced a system that allows for the reduction, non-payment, or full or partial return of the annual bonus based on a resolution of the Board of Directors following deliberation by the Compensation Advisory Committee.

Additionally, in the restricted stock compensation plan, if the recipient commits a violation of laws or internal regulations, we have stipulated in the restricted stock allocation agreement that the company can acquire all of the granted shares without compensation. - 6Process of determining compensation

-

Policies on determining compensation for directors are deliberated objectively at a meeting of the Compensation Advisory Committee, composed of a majority outside directors, and ratified by resolution of the Board of Directors based on the Committee's recommendations. The amount of each director’s compensation, including an assessment of a non-financial evaluation portion of annual bonuses and additional delivery of restricted stock based on corporate value evaluation, is determined by deliberation of the Compensation Advisory Committee to which the Board of Directors has resolved to delegate authority

Deliberations of the Compensation Advisory Committee are conducted from an objective viewpoint and by referring to expertise about compensation systems.

Accordingly, information is obtained from an outside expert agency (Willis Towers Watson in fiscal 2024) when necessary. The following are the members of the Compensation Advisory Committee who deliberated policies for the 75th fiscal year and their activities during the fiscal year.

Members

- Takashi Kamio, Outside Director (Chairman of the Committee)

- Tadashi Ogura, Outside Director

- Kumi Sato, Outside Director

- Hiroyasu Naito, President and Representative Director

(Note)

Nobuyuki Matsui resigned as an outside director at the 74th regular shareholders' meeting held on June 27, 2024.

Kumi Sato was newly appointed as an outside director and assumed the position of a compensation advisory committee member at the 74th regular shareholders' meeting held on June 27, 2024.Activities

- February 29, 2024: Deliberation on the revision of the policy for determining individual compensation for directors in the 75th term.

- May 17, 2024: Deliberation on the individual amount of executive compensation (directors) for the 75th term.

- June 27, 2024: Selection of the compensation advisory committee chairman and deliberation on the individual amount of executive compensation (directors) for the 75th term.