Financial Results Highlights

(Fiscal 2025)

Performance

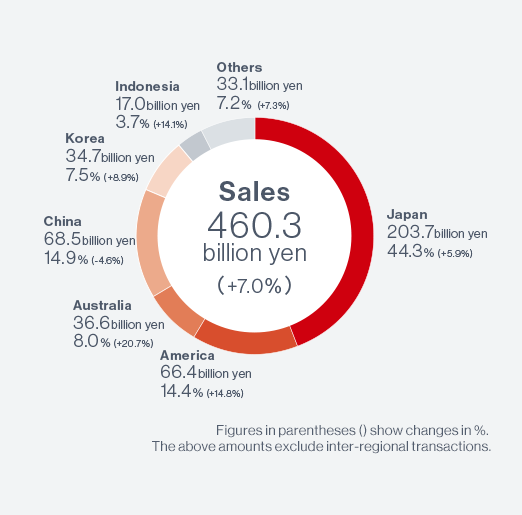

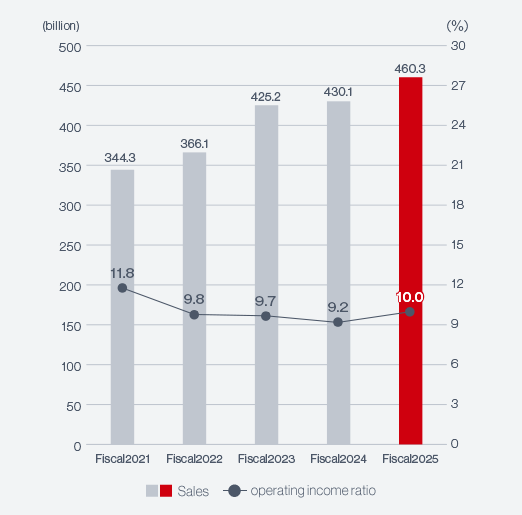

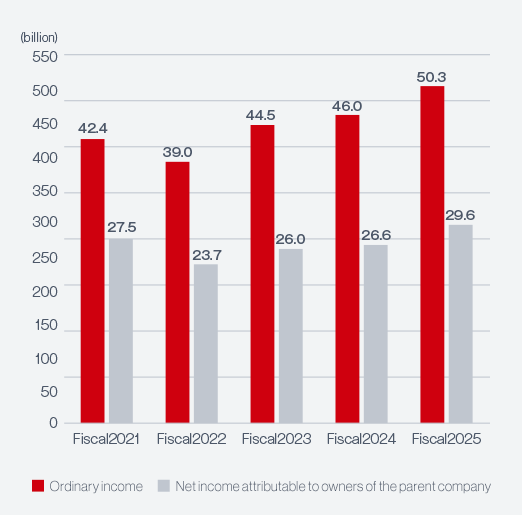

Consolidated net sales for the year amounted to ¥460,319 million, up 7.0% from the previous year. Operating income increased 16.9%, to ¥46,005 million, and ordinary income rose 9.2%, to ¥50,323 million. million. Net income attributable to owners of the parent company climbed 11.3%, to ¥29,691 million.

Results by Geographical Segment

-

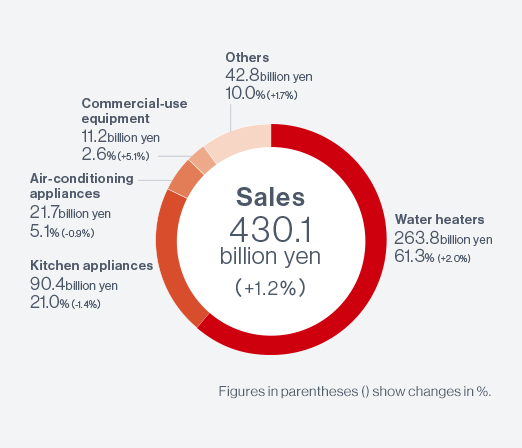

Japan

Amid a stable business environment driven by real demand, sales of key products grew significantly. These included our ECO ONE hybrid water heaters and heating systems, supported by subsidies for high-efficiency water heaters, as well as our highly distinctive gas clothes dryers and air bubble-related products. As a result, sales in Japan grew 5.9% year on year, to ¥203,731 million. On the earnings side, operating income rose 24.2%, to ¥22,309 million, despite incurring ¥2.7 billion in expenses related to free inspections of bathroom heater/dryers.

-

United States

Although consumer sentiment in the housing appliance market remained sluggish, growing concern about energy efficiency led to expansion of the tankless water heater market. Our performance also benefited from firm sales of our core condensing water heaters, launched at the beginning of the fiscal year. As a result, sales in the United States increased 14.8%, to ¥66,457 million, and operating income totaled ¥2,130 million, compared with an operating loss of ¥1,197 million in the previous fiscal year.

-

Australia

While the new housing market showed signs of recovery, the overall housing market remained sluggish. However, sales of core gas appliances firmed due to the harsh winter, and we made a corporate acquisition to meet the trend toward electrification. As a result, sales in Australia rose 20.7%, to ¥36,605 million. Despite the increase in revenue, operating income declined 10.2%, to ¥1,119 million, due to the amortization of goodwill and other expenses related to our corporate acquisition, which prevented profit growth.

-

China

Although consumer sentiment declined sharply in the second half of the year and distribution inventory levels remained high, e-commerce sales -which have accounted for an increasing share of total revenue in recent years- held steady. As a result, sales in China were down 4.6% year on year, to ¥68,596 million. Operating income declined 16.9%, to ¥10,095 million, the decline in revenue was suppressed through management efforts that included improving the sales ratio of mainstay PF2.0 water heaters, which have built-in cost efficiency.

-

South Korea

In South Korea, our core boiler business faced ongoing price competition amid a weakening economic outlook. In response, we launched a new boiler equipped with ultra-fine bubble technology, aimed at differentiating our products from those of competitors. As a result, sales in South Korea increased 8.9% to ¥34,719 million, and operating income was ¥930 million, compared with ¥16 million in the previous fiscal year.

-

Indonesia

Amid weak consumer sentiment due to rising prices, we implemented price revisions for mainstay tabletop stoves, which maintain a high market share. In addition, sales of high-end built-in hobs (stovetops) and range hoods grew steadily. As a result, sales in Indonesia rose 14.1% year on year, to ¥17,010 million, and operating income jumped 39.9%, to ¥3,842 million.